Crude oil barrels. Source of image: Presstv

Data available on the petroleum corporation of Jamaica's (PCJ) website, suggests that 46 per cent of Jamaica's petroleum consumption is used in the transport sector, 33 per cent in electricity generation, 14 per cent in the bauxite/alumina sector, etc. Additionally, it is said that crude oil accounts for approximately 40 per cent of local imports; estimated to be in excess of US $2 billion. A figure comparable to earnings from the hospitality and tourism sector.

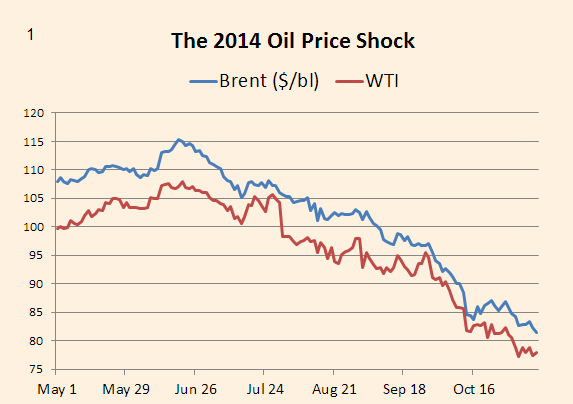

However, as we've seen over the years, the price of crude oil has been quite volatile. Placing Jamaica in a vulnerable position whenever a global oil spike occurs. Conversely, a precipitous decline in crude oil prices should benefit Jamaica. This scenario is playing out at the moment. The precipitous decline began in July 2014, largely attributable to excess crude oil supply, and weak global demand.

Chart showing a precipitous fall in Crude oil prices. Source of image: Financial Times

Additionally, as stated in my blog post entitled Could The US Help To Solve Jamaica's Energy Woes?, technological developments in hydraulic fracturing has led to a shale oil boom in the US. Moreover, America's demand for foreign oil has decreased significantly. In addition to the shale oil boom, organization of petroleum producing countries (OPEC) is insistent on maintaining current production levels. Combined with an increase in more efficient cars, this has led to an oil glut.

Additionally, as stated in my blog post entitled Could The US Help To Solve Jamaica's Energy Woes?, technological developments in hydraulic fracturing has led to a shale oil boom in the US. Moreover, America's demand for foreign oil has decreased significantly. In addition to the shale oil boom, organization of petroleum producing countries (OPEC) is insistent on maintaining current production levels. Combined with an increase in more efficient cars, this has led to an oil glut.

Should We Hedge?

For the first time in years, motorists are enjoying the benefits of lower oil prices. Not to forget lower Chicken, Bread and electricity prices. On the government side, lower crude oil prices has resulted in a moderation of the inflation rate. This bodes well for consumer spending, and should allow for greater general consumption tax (GCT) intake. Additionally, a shrinking import bill should follow the lower oil prices.

However, crude oil prices are unlikely be suppressed indefinitely. In fact, signs are emerging that the sharp fall in oil prices has abated, with crude oil prices ending the week above US $50 per barrel. It is in this regard, suggestions have been made by the private sector organization of Jamaica (PSOJ), that Jamaica should consider hedging. Hedging is done to limit price volatility of investments, oil typifies volatility.

In this instance, hedging should provide Jamaica sufficient time to correct perennial problems with electricity generation, thereby lowering the cost of electricity. Seemingly, this is the expectation. Word coming from the electricity sector enterprise team (ESET), implies that 330 megawatts of power should come on stream by 2018. 190 megawatts in Old Harbour by the Jamaica public service company (JPS), and 140 megawatts by Aluminum partners of Jamaica (ALPART).

If prudent steps are taken by the government, Jamaica should be well on its way to energy security.

I will certainly revisit the aforementioned topic in the near-term.

If prudent steps are taken by the government, Jamaica should be well on its way to energy security.

I will certainly revisit the aforementioned topic in the near-term.

References

Consumption statistics by activity, petroleum corporation of Jamaica.

http://www.pcj.com/dnn/Statisticsbyactivity/tabid/143/Default.aspx

http://www.pcj.com/dnn/Statisticsbyactivity/tabid/143/Default.aspx

No comments:

Post a Comment